Chartered Financial Solutions (CFS) has been helping clients plan and achieve their financial goals since early 2005. We advise on over €200 million of pension and investment assets on behalf of a broad range of clients.

CFS is Mark Haskins and Shane Brennan, supported by the hard-working administration team, led by Kate Duffy as the operations manager.

Sadly, our other founding director, Justin Prendergast, passed away suddenly in 2015. Justin was an integral part of the successful growth of our business, and a great friend.

We’ve developed the business and travelled alongside our clients since the very beginning. CFS values long-term relationships with clients; we’re not interested in short-term transactions. It means consistency, continuity, and confidence in a professional approach, which will continue to be our key focus going forward. We are proud to confirm that many of our clients have been with us since 2005, a good testament to these aspirations.

Our fundamental goal is to provide first class impartial advice to retail clients and SMEs, and we are primarily active in the area of pension planning. Since 2005, we have built a successful client facing brokerage based in Ranelagh.

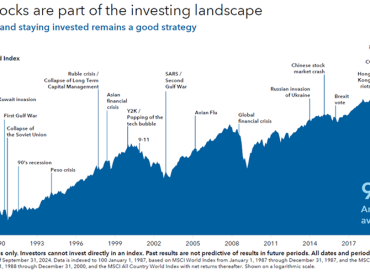

We specialise in empowering owner-directors, senior executives and the self-employed to make well informed decisions with the goal of achieving great long-term financial outcomes.