What strange and challenging times we are all living in. As Covid-19 continues to restrict

all of us in Ireland and around the world, everyone is very concerned about their health and

that of their loved ones. Levels of concern are then also heightened for many people

who are looking at reductions in their income or indeed the complete loss of

employment.

And then just to add to all of this, we have seen sharp falls and continuing volatility in

stock markets, which is causing further anxiety for investors and pension fund holders

around the world. With this in mind, we thought it might be helpful to give you our

thoughts on how to view your investments in these fraught times.

Don’t Panic – Stick to The Plan

Firstly, all of your concerns are very understandable and to be expected, as no-one likes

to see their wealth reduce. We feel your pain and indeed we share it, as our own funds

are invested in the same way. We want to give you a few thoughts on why we believe the

best approach is to sit tight, definitely not to panic and to stick to your financial

plan. Rash decisions taken today are likely to hurt you in the long run.

There is Nothing Unprecedented About a Market Correction

The emergence of a global pandemic is unprecedented for us all, indeed hopefully it will be

a once in a lifetime event. But stock market corrections happen regularly as part of the

normal investment cycle.

If you think back to the last major correction which happened as a result of the

economic crash in 2008/2009, people felt markets would never recover. The bottom of the

market came on 6th March 2009, when the S&P 500 index sat at 666 points. Roll forward

ten years then to 6th March 2019, and the market stood at 2,792 points, an increase of

over 310%.

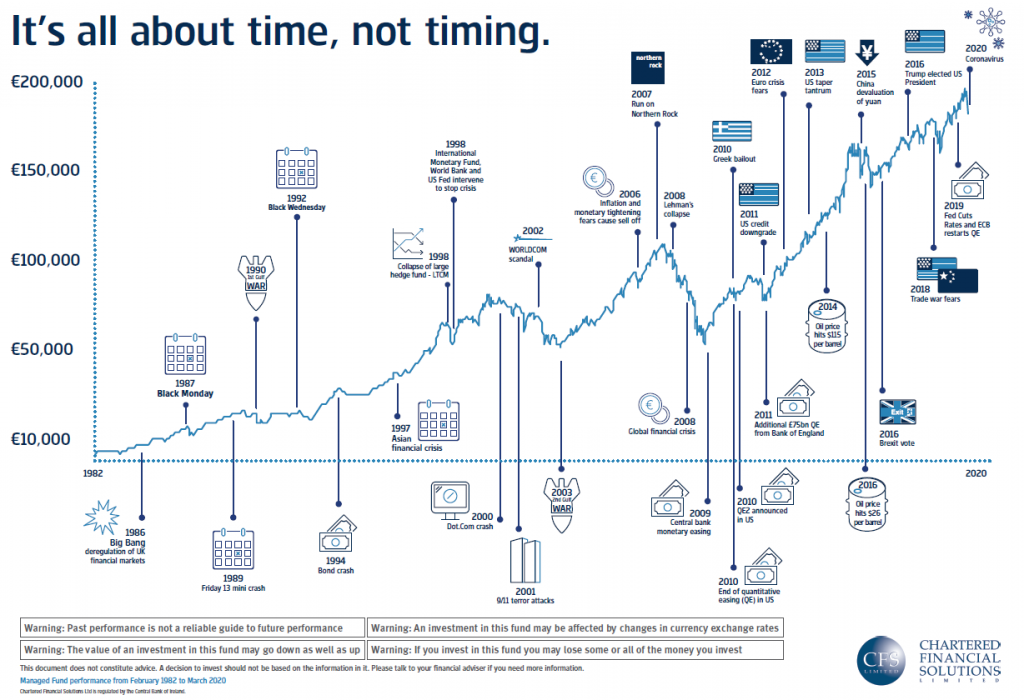

Now we can’t promise this will happen again, but stock markets have shown time and again

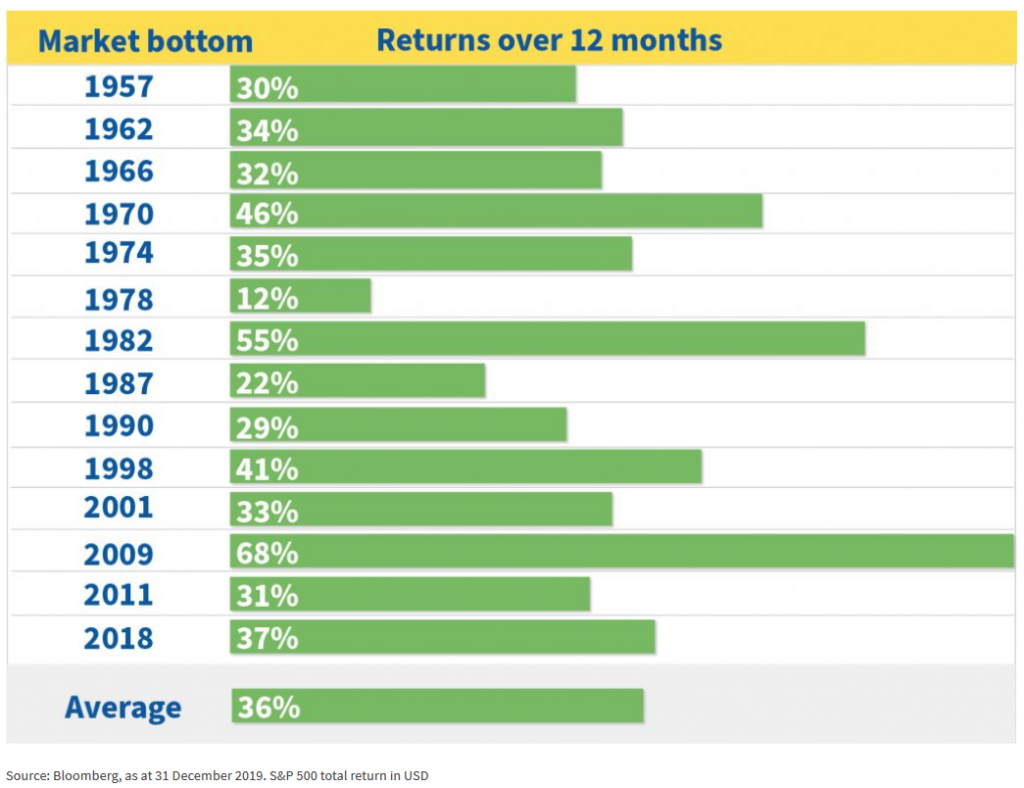

in history that they fall and then they recover and push further ahead. The chart below

illustrates this point. This is the returns in the US S&P 500 share index in the 12 months

following various falls in the past.

As you can see, when markets recover, they recover strongly. This can indeed present a

buying opportunity.

So This Volatility is Normal?

Volatility, while uncomfortable, is normal. Of course, there are times of low volatility in

markets and other times, such as today, when this is heightened. Again, this is simply a feature

of investment markets. Over any 10 year equity investing period in the past however, the

odds of ending with losses are just 4%.

The Key is Time in the Market, Not Market Timing

Some people have asked us in recent weeks should they move to cash. We don’t have a crystal

ball as to where markets will go, but we know from experience that trying to time markets is

not easy.

What inevitably happens is that people exit markets when they are cheap (after they have

fallen), and then as they rebound again, investors go back in too late when the market has

recovered. How do you know when is the right time to go back in? What will the recovery

look like?

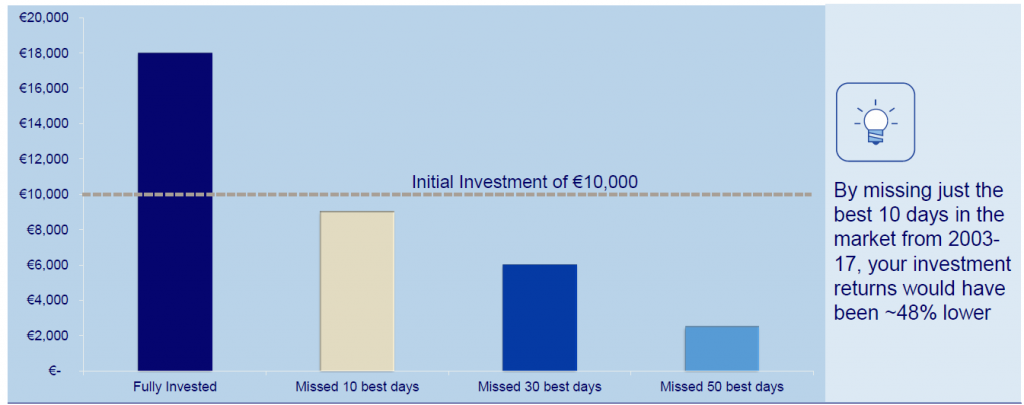

Trying to time the stock market is notoriously difficult, as the chart below indicates. This is an

investment of €10,000 in the MSCI Europe Index from 2003 to 2017. As you can see, missing

just 10 investing days can drastically affect your returns.

Source: JP Morgan & Zurich Life

Time in the market, as opposed to market timing, is the key to long term success, so we

suggest you sit tight, ignore the short-term volatility and maintain your long-term perspective.

What Do Wise Investors Do?

The truth of the matter is that in the fullness of time, experienced fund managers will reflect

on the recent falls in markets as a buying opportunity, as opposed to the time to get out of

markets. Stocks are cheaper today than they were a few weeks ago. If you are a regular

investor into your pension fund or savings plan, now is the time to keep saving – after all, there

is a temporary sale happening!

As the wisest investor of them all Warren Buffett says: “The stock market is a device for

transferring money from the impatient to the patient.” Impatient people sell in depressed

markets and take hurried, rash decisions that usually cost them money. Patient people sit

tight.

So, What Should You Do Now?

Our advice is to ignore the short-term events and follow your plan. You are investing for a

medium to long time, and this is simply one event in the market cycle. This should not throw

your plan off course. Keep the following key principles in mind:

If you would like some further reassurance, please feel free to call us as we are always happy

to chat through any concerns you might have.For those of you with significant assets in cash,

now might be the time to consider investing a portion of these assets into a discounted

market.

In the meantime, focus your energy on keeping yourself and your loved ones healthy. Stay

safe.

Regards from the team at CFS.