CFS Joins Forces with Howden Group – 9th April 2025 Following a review of our long-term strategy, the directors of CFS have agreed to an acquisition of the firm by the Howden Group, subject to Central Bank of Ireland approval. Howden is one of the largest privately owned insurance brokers in the world, with over 18,000 employees across 55 countries. …

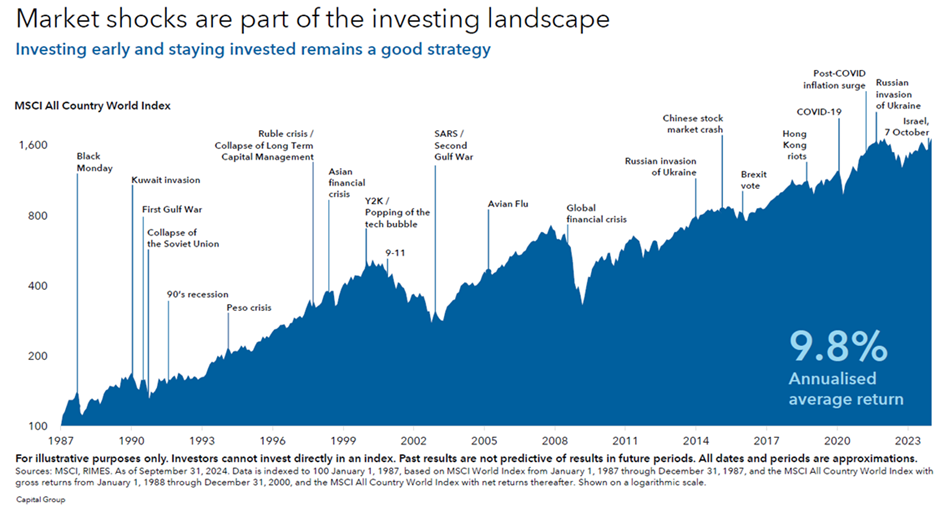

Read MoreMarket Volatility – 7th April 2025 Global stock markets have tumbled in recent days in response to Donald Trump’s proposed tariffs. As of the 4th April, the US stock market is down 18% in euro terms year to date, while Europe is down 5% year to date as of this morning. All major equity markets have fallen sharply earlier this …

Read MorePension Fund Threshold Changes On the 18th September 2024, the Department of Finance released recommendations following an independent review of the Standard Fund Threshold (SFT) and other pension limits. Here are the key takeaways from the proposed changes: Standard Fund Threshold Increases: The SFT, currently set at €2 million, will rise progressively by €200,000 annually from 2026 until reaching €2.8 …

Read MoreAuto Enrolment – Guidance for Employers As there has been lots of media coverage on the Irish Government’s proposed Auto Enrolment (AE) scheme recently, here is some guidance as to how the proposed scheme will impact employers in Ireland. Background After many years of procrastination, we are closer than ever to seeing AE implemented in Ireland. There are estimated to …

Read MoreWhat strange and challenging times we are all living in. As Covid-19 continues to restrict all of us in Ireland and around the world, everyone is very concerned about their health and that of their loved ones. Levels of concern are then also heightened for many people who are looking at reductions in their income or indeed the complete loss …

Read More22nd March 2019 – LPI Dublin Broker of the Year We were absolutely delighted to win the prestigious LPI Dublin Broker of the Year award at last night’s ceremony in the Mansion House. This was our first year entering these awards, so it doesn’t get much better than this! These awards aim to give recognition to life, pension and investment …

Read MoreAs the whole world no doubt knows, today is the day that the General Data Protection Regulations (GDPR) come into force. Accordingly, we have updated our privacy statement, linked here. Please feel free to read through this document and let us know if you have any questions at all.

Read MoreFollowing recent regulatory changes, we have updated our terms of business, effective immediately. You can view these updated terms here.

Read MoreIn recent years it seems that most of the budget is leaked in advance, and this year was no exception. For your convenience, we have highlighted the key points of today’s budget in this update. From a pensions perspective, the state pension will increase by €5 per week from March 2017. Tax relief on pension contributions also remains at 40% …

Read MoreFrom 22 June 2016, Revenue practice for retirement options on the treatment of Personal Retirement Bonds (PRB’s) for former members of Defined Benefit schemes has changed. Previously, these policyholders had to take benefits under the ‘traditional’ revenue formula of: a lump sum based on salary and service from the previous employer, and the remainder of the fund had to be used to …

Read More