Market Volatility – 7th April 2025

Global stock markets have tumbled in recent days in response to Donald Trump’s proposed tariffs. As of the 4th April, the US stock market is down 18% in euro terms year to date, while Europe is down 5% year to date as of this morning. All major equity markets have fallen sharply earlier this morning, while bond funds have been fairly resilient so far.

Markets detest uncertainly, and we have that in spades right now. As ever, sharp market moves tend to create unease, so we wanted to take a moment to offer a few thoughts to help provide clarity and reassurance during this period.

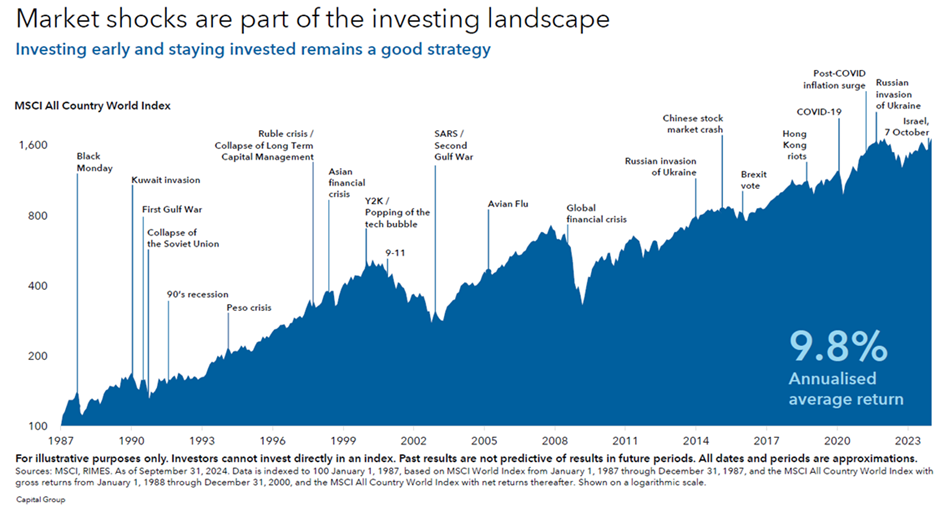

Firstly, we’ve been here before. Whether it was the financial crisis of 2008, the dot-com bubble, Brexit, or the 2020 Covid sell-off, markets have always gone through turbulent times. And they have always recovered

Our advice remains the same: don’t panic, stick to your plan.

Your investment strategy was designed with periods like this in mind — it is well-diversified, long-term, and robust. History consistently shows that those who remain invested through uncertainty are the ones who benefit most over time.

It’s important to remember:

- Volatility is normal. This isn’t a flaw in markets — it’s a feature.

- Switching to cash is usually a mistake. Attempting to time the market often results in missing the strongest recovery days.

- Time in the market beats timing the market. As our previous updates have shown, staying invested is the most reliable way to grow your wealth.

Periods like these often lead to emotional decision making. But as Warren Buffett reminds us, “The stock market is a device for transferring money from the impatient to the patient.” We strongly encourage you to stay the course and focus on the long-term plan we’ve put in place.

The chart above illustrates this point succinctly; this is the MSCI World Equity Index from 1987 to 2024. Despite numerous shocks along the way, equity investors enjoyed a return of 9.8% per annum through this period.

We hope this is helpful in this volatile time, and please reach out if you have any questions at all.